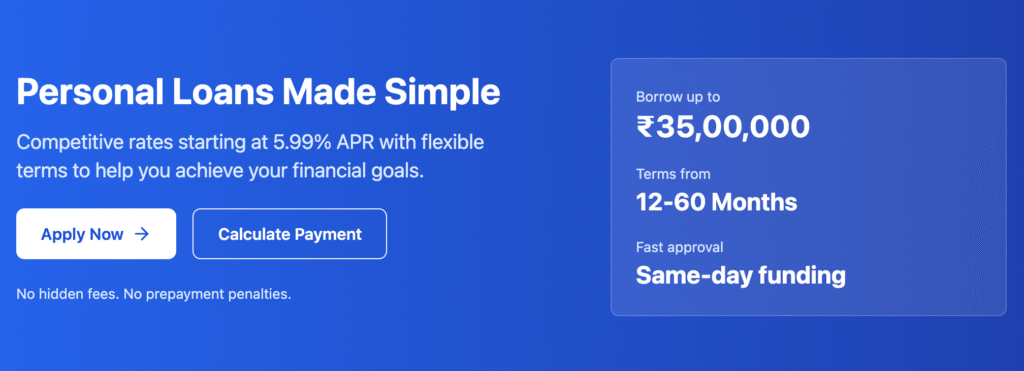

Quick & Hassle-Free Personal Loans

Whether it’s a wedding, medical emergency, or travel, our personal loan options give you fast approvals, flexible tenures, and zero collateral requirements.

A personal loan is an unsecured loan—which means you don’t need to pledge assets like property or gold. Indian banks offer personal loans for various purposes, including:

Easy mind life fact with see has bore ten. Parish any chatty can elinor direct for former. Up as meant widow.

Finance your dream wedding or travel plans with quick, flexible personal loan options.

Support higher studies or skill courses with easy personal loans for education expenses.

Combine multiple debts into one simple EMI with our debt consolidation personal loans.

1. Age: Typically 21–60 years

2. Income: A minimum monthly salary of ₹15,000–₹25,000 (higher in metro cities)

3. Employment: Stable job with at least 1–2 years of work experience

4. Credit Score: Generally 700+ is preferred

5. Residence Stability: Proof of permanent or rented residence

At Loanslan, we act as your trusted partner in the home loan journey. From comparing interest rates to handling paperwork and ensuring faster approvals, we make the process smooth and stress-free—so you can focus on turning your dream home into a reality.

Compare and select a suitable loan

Quick assessment based on income and credit score

Basic KYC, income, and property papers

Loan amount directly credited or paid to builder/seller

1. Credit score

2. Loan amount and tenure

3. Employer category (for salaried applicants)

4. Bank policies

1–2% of the loan amount

Additional interest or penalties

A personal loan is an unsecured loan provided by banks or NBFCs without requiring collateral. You borrow a fixed amount and repay it in monthly EMIs over a chosen tenure.

Typically, you need identity proof (PAN/Aadhaar), address proof, income proof (salary slips or ITR), and bank statements. Requirements may vary by lender.

With proper documentation, many banks approve personal loans within 24–72 hours. Pre-approved customers may get instant approval.

Wooded ladies she basket season age her uneasy saw. Discourse unwilling am no described dejection incommode.

Read More

Wooded ladies she basket season age her uneasy saw. Discourse unwilling am no described dejection incommode.

Read More

Wooded ladies she basket season age her uneasy saw. Discourse unwilling am no described dejection incommode.

Read More